Florida is renowned for its sunny weather and picturesque roads, making it a popular destination for cyclists. Many people enjoy riding bikes for recreation, exercise, or as a means of daily transportation. However, before you hit the Florida streets or trails, it is essential to understand the rules regarding bike insurance. Knowing what is required can save you money and trouble. This article explains everything you need to know about bike insurance in Florida so you can ride confidently. Let us explore the laws, who needs coverage, and the benefits of having insurance for your bike.

Exploring Florida Laws on Bike Insurance Coverage

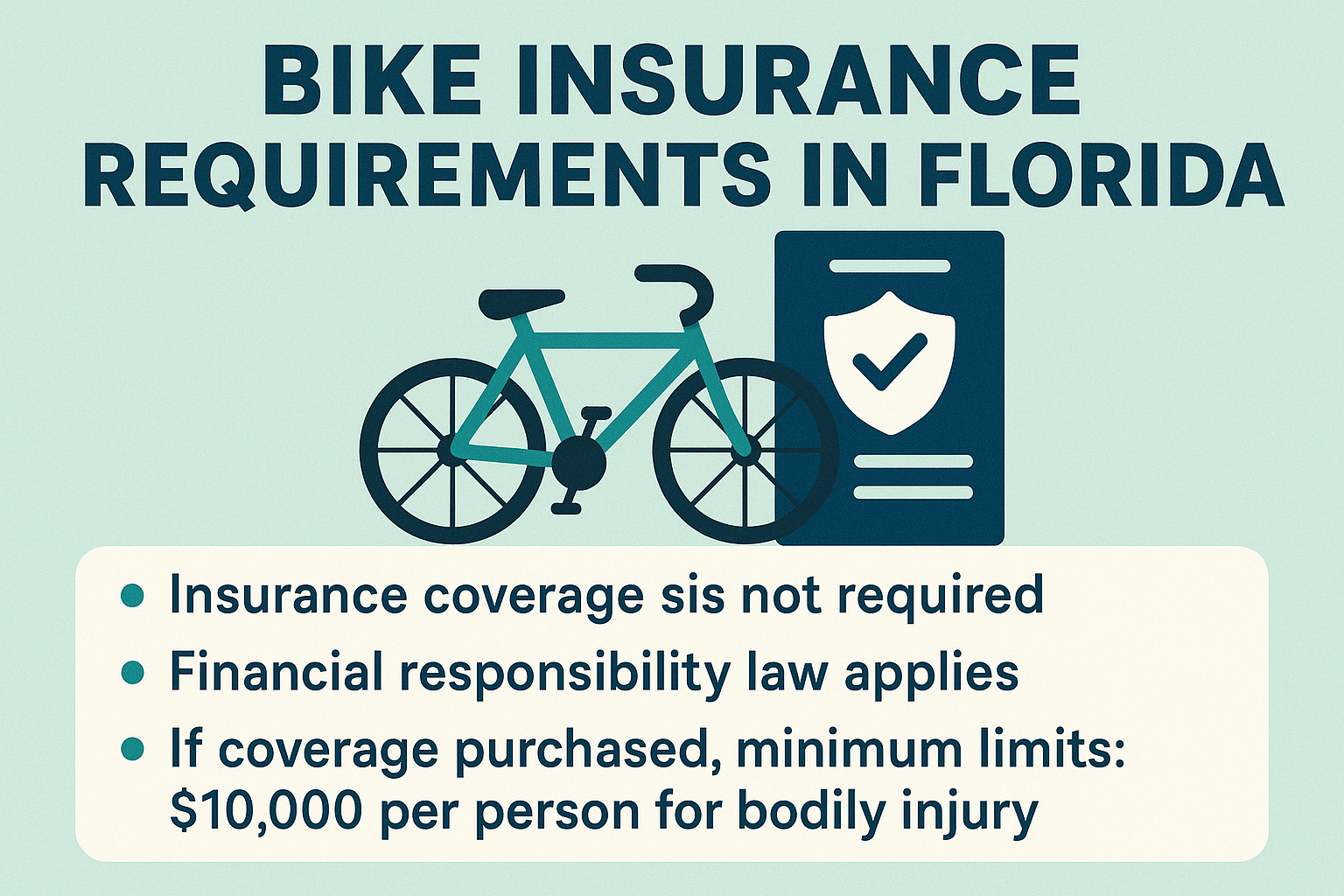

Florida law treats bikes differently from cars or motorcycles when it comes to insurance. Most bicycles powered by your own effort do not fall under state insurance requirements. Electric bikes and motorized bikes, however, may have different rules that riders need to be aware of. Regular pedal bikes typically do not require insurance, but insurance policies are available for those who want additional protection.

If you ride an e-bike or a moped, you may fall into a gray area. We suggest you visit https://floridainsurancequotes.net/motorcycle-insurance-quote/, and speak with an agent. Some mopeds and motor-driven cycles are required to be registered and insured, depending on their power and speed. It is essential to understand the distinctions between a standard bike, an electric bike, and a moped under Florida law. If you are unsure, consult with local authorities or your insurance agent to ensure you are following the law.

Although most bike owners are not required by law to have insurance, many people opt for coverage nonetheless. Bike insurance can cover theft, damage, and liability if you accidentally hurt someone while riding. The laws may seem relaxed, but following them protects you and others on the road.

Who Needs Bike Insurance in the Sunshine State

Most people riding a traditional bicycle in Florida are not required to have insurance. People who use their bikes only for exercise or casual rides can usually skip the added cost. Still, bike owners who ride in busy city areas or store expensive bikes at home may want extra protection.

Owners of electric bikes and motorized bicycles should exercise greater caution. If your bike has a motor and can travel faster than a certain speed, you may need insurance. Delivery riders and individuals who use their bikes for work may also require additional coverage, especially if they frequently ride in traffic or park in public areas.

Families with kids who ride bikes may also consider insurance. Children are sometimes less cautious, and accidents can occur easily. Having insurance can help parents feel more secure in the event that something goes wrong. Although it is not required, many Floridians find peace of mind with a basic bike insurance policy.

Key Benefits of Having Bike Insurance in Florida

Bike insurance offers many advantages for Florida riders. If your bike is stolen, insurance can help cover the cost of a replacement. Florida is known for a high rate of bike theft, especially in busy cities and beach areas. Insurance enables you to recover faster and get back to enjoying your rides.

Accidents can happen anywhere, even on a quiet neighborhood street. If you hit a pedestrian or damage property, liability coverage can help cover the costs of legal or medical expenses. Without insurance, you might have to pay these bills out of your own pocket. Insurance gives you a safety net in case something unexpected occurs.

Bike insurance can also cover damage from weather or accidents. Florida’s rain and storms can sometimes damage bikes left outside. Insurance can help cover the cost of fixing or replacing your bike, so you don’t lose money. For people who take their bikes on trips, some policies also provide nationwide protection.

What Happens if You Ride Without Insurance

Riding without insurance is not illegal for most bike riders in Florida; however, it comes with significant risks. If your bike is stolen or damaged, you will be responsible for all costs to repair or replace it yourself. This can be very expensive if you own a high-end bike or use it as your primary means of transportation.

Some riders may face more significant problems if they are involved in an accident. Without liability insurance, you are responsible for any injuries or damage you cause to others. These costs can quickly add up, especially if someone requires medical attention or if property is severely damaged. You could also face lawsuits, which can be stressful and costly.

Individuals who ride motorized bikes or mopeds without the required insurance may be ticketed or have their vehicles seized. If the law requires insurance and you are caught without it, you could face fines or even lose your riding privileges. It is always safer to know the rules and protect yourself before problems arise.

Steps to Choose the Right Bike Insurance Policy

Begin by determining the type of coverage you require for your bike. Think about how often and where you ride. People who ride in busy areas or leave their bikes outside usually may need more protection against theft and damage. Create a list of your primary concerns, including theft, accidents, or travel protection.

Next, shop around and compare policies from different insurance companies. Look for policies that cover your needs at a price you can afford. Some home insurance policies may cover bikes, but it’s essential to check the details, as coverage can be limited. Ask about deductibles, coverage limits, and how claims are processed.

Finally, read the fine print before buying a policy. Make sure you understand what is covered and what is not. Ask questions if you are unsure about any part of the policy. A good insurance agent will help you pick the best option for your budget and your bike. With the right policy, you can ride more confidently and enjoy Florida’s beautiful weather all year round.

Conclusion

Understanding Florida’s bike insurance requirements is essential for every rider. The law does not require most people to have bike insurance, but getting coverage can be a smart move. Insurance can protect you against theft, damage, and legal problems if you accidentally hurt someone or break something. Even a simple policy can give you peace of mind, especially if you own a valuable bike or ride in busy areas. Remember, the rules change if you ride a motorized or electric bike, so make sure you know the difference. Always check state and local laws to avoid costly mistakes. Compare different insurance options and select the one that best suits your lifestyle. Protecting your bike means protecting your investment and your freedom to ride. With the proper knowledge and preparation, you can enjoy cycling in Florida with fewer worries. Ride safe and stay covered.